Our Pacific Prime Statements

Our Pacific Prime Statements

Blog Article

Get This Report on Pacific Prime

Table of ContentsPacific Prime Things To Know Before You BuyPacific Prime for DummiesHow Pacific Prime can Save You Time, Stress, and Money.Not known Facts About Pacific PrimePacific Prime - Truths

Your agent is an insurance professional with the knowledge to assist you via the insurance policy procedure and aid you locate the most effective insurance defense for you and the individuals and points you respect most. This post is for educational and suggestion objectives only. If the plan insurance coverage summaries in this post conflict with the language in the policy, the language in the plan applies.

Insurance policy holder's deaths can additionally be backups, particularly when they are taken into consideration to be a wrongful fatality, as well as property damages and/or destruction. Because of the uncertainty of said losses, they are classified as contingencies. The insured individual or life pays a costs in order to receive the advantages guaranteed by the insurer.

Your home insurance can aid you cover the problems to your home and manage the cost of restoring or fixings. In some cases, you can likewise have coverage for items or belongings in your residence, which you can then purchase substitutes for with the cash the insurance provider provides you. In case of a regrettable or wrongful death of a single earner, a household's financial loss can potentially be covered by specific insurance policy plans.

Pacific Prime Fundamentals Explained

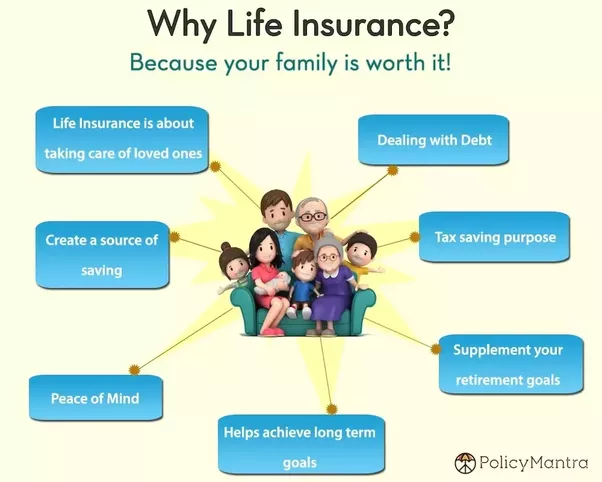

There are different insurance coverage plans that include savings and/or investment systems along with routine insurance coverage. These can aid with building financial savings and wide range for future generations using routine or repeating investments. Insurance policy can help your family maintain their standard of life on the occasion that you are not there in the future.

One of the most basic kind for this sort of insurance, life insurance policy, is term insurance coverage. Life insurance policy as a whole helps your household become safe and secure economically with a payment quantity that is given up the event of your, or the plan owner's, fatality throughout a specific plan period. Child Plans This sort of insurance coverage is essentially a cost savings tool that aids with producing funds when youngsters get to specific ages for going after college.

Home Insurance coverage This type of insurance coverage covers home problems in the cases of mishaps, natural calamities, and problems, in addition to other comparable events. group insurance plans. If you are aiming to seek settlement for crashes that have taken place and you are battling to figure out the proper path for you, reach out to us at Duffy & Duffy Legislation Company

See This Report about Pacific Prime

At our law office, we understand that you are undergoing a whole lot, and we recognize that if you are involving us that you have actually been with a whole lot. https://www.intensedebate.com/profiles/pacificpr1me. As a result of that, we provide you a free examination to discuss your worries and see how we can best assist you

Due to the fact that of the COVID pandemic, court systems have actually been shut, which negatively impacts automobile crash cases in an incredible means. Again, we are below to help you! We happily serve the individuals of Suffolk Area and Nassau Area.

An insurance coverage is a legal contract in between the insurance policy company (the insurance provider) and the person(s), company, or entity being guaranteed (the insured). Reading your policy assists you confirm that the plan meets your needs and that you understand your and the insurance provider's obligations if a loss happens. Lots of insureds buy a blog here policy without comprehending what is covered, the exemptions that remove insurance coverage, and the problems that must be satisfied in order for coverage to apply when a loss happens.

It identifies who is the insured, what threats or residential property are covered, the plan restrictions, and the plan duration (i.e. time the plan is in pressure). The Statements Web page of a life insurance coverage plan will consist of the name of the person guaranteed and the face quantity of the life insurance coverage plan (e.g.

This is a recap of the major guarantees of the insurance firm and mentions what is covered.

Examine This Report on Pacific Prime

Life insurance policy policies are commonly all-risk plans. https://yoomark.com/content/we-are-award-winning-insurance-intermediary-choice-simplifying-world-insurance-help-you-find. The three major types of Exclusions are: Left out perils or causes of lossExcluded lossesExcluded propertyTypical examples of left out dangers under a house owners plan are.

Report this page